|

.jpg)

Henry M.

Seggerman

President

International

Investment

Advisers | By

Henry M. Seggerman

President of International

Investment Advisers

Remember “Buy Korea to Save Korea”? That was the hype that drove a record 13 trillion won, most of it from ordinary retail investors, into a massive equity fund pile-up eight years ago. All that money didn’t really go into equities, but instead much of it went into unstable bonds and commercial paper of near-bankrupt chaebols, which the financial institutions wanted to offload from their own proprietary accounts. The whole fraudulent house of cards collapsed, a prominent brokerage President went to prison, and yet again, the good old Korean taxpayer came to the rescue, bailing out all those gullible fund investors with an assortment of government guarantees designed to protect the principal investments made. I sure wish Uncle Sam would bail me out with taxpayer money every time I invest in a loser mutual fund here!

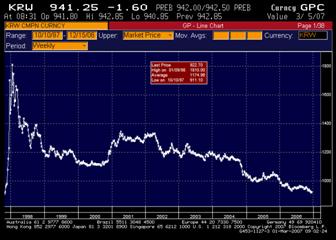

Well, the slogan from the last few months is something like “Buy China to Save Korea.” Late last year, with the Won trading close to a ten-year high, Korea’s crucially important exports sector was seeing its margins shrink or disappear altogether. So, the government came up with the fine idea of driving some investment money offshore, with the goal of weakening the Won. This would be accomplished by cutting the 15.4% Capital Gains tax on foreign investments. And in order to prime the pump, they whispered to all their buddies in the domestic brokerage business, “Hey guys, we are gonna let you have easy entry to this new goldmine by giving you exclusive control of the Capital Gains slash.” Foreign fund managers were simply forbidden from selling any of these hot new non-Korean funds, or broking non-Korean stocks to Koreans, without Capital Gains taxes.

KRW near a ten-year high

So the aggressive marketing began, and these tax-free non-Korean funds took off like a rocket, along with plenty of direct stock investing. And one of the biggest pushes was into the China stock market. This became a scene of absolute panic buying, with Korean retail investors even paying fees to local Chinese investors to use their names in order to circumvent stock market registration requirements.

But – even after the crash -- the Shenzhen stock market trades at a Price Earnings (PE) Ratio of 73 times trailing (and Shanghai 35 times), compared with the Korean stock market which trades at a PE of 13 times. With so much evidence of burst stock market bubbles in the past, who in their right mind would want to get caught up in all this irrational exuberance? Thousands and thousands of Korean retail investors, that’s who. This nonsensical stampede has given a whole new meaning to “buying at the top.”

China Massively Overvalued

As Koreans rushed in like lemmings, the Chinese market was an accident waiting to happen. Any market that doubles in seven months is guaranteed to correct down sharply. China is an extremely volatile market. Just look how it plunged 35% during a few short months the middle of 2001, when it had not experienced anything like 2006’s exponential rise. This is entirely about market overvaluation, and has nothing whatsoever to do with China’s economy, which will continue to grow at rates near 10% for a number of years. My prediction is that Shenzhen will continue to correct down to PE 35 times and Shanghai to PE 20 times. This is not a buy-the-dip opportunity. Any rebound is a selling opportunity.

-

Irrational Exuberance

Of course, not all Koreans invested in China funds. So, if you were lured into other highflyer markets like Indonesia (PE 23 times) or India (PE 24 times), the same thing applies. These markets are still overstretched and will correct down further in coming weeks. The February 27 worldwide market plunge will cause retail and institutional investors worldwide to rethink all high-priced assets and also sell any investment whose primary thesis was momentum -- if you can even call that a thesis. Reasonably valued markets like Korea will resume rising steadily very soon. The U.S. economy is not going to crash because the overheated Chinese market crashed, and will continue growing steadily.

Foreign fund managers like Fidelity were deliberately excluded from the Capital Gains tax slash goldmine. Would they have sold Korean retail investors less risky, more reliable products? Who knows? After all the initial torrential inflows had died down, the government -- goaded by accusations once again of a very bumpy playing field -- did indicate foreign fund managers might possibly join in. However, it was conditioned upon a long litany of required disclosures (no doubt including a complete list of billionaire client home phone numbers), and the foreigners politely declined. The game was over, anyway. Xenophobia is just so exhausting.

So, did Koreans “Buy China and Save Korea?” Did the Won weaken? One might argue that it fell from 915 to 940 since discussions of the Capital Gains tax cut began in December, but it has steadfastly remained in the 930 – 940 range since the actual implementation on January 14. So, it cannot be said today that Korean exporters are getting the 975-1,000 level which would give them some tangible bottom-line relief. That’s the sad irony in this whole foolish episode.

Effect of Capital Gains tax cut on KRW

|